Bear Put Calendar Spread. A bearish calendar spread consists of two options. “i've said it earlier, trading.

A calendar spread is an options or futures strategy where an investor simultaneously enters long and short positions on the same underlying asset but with.

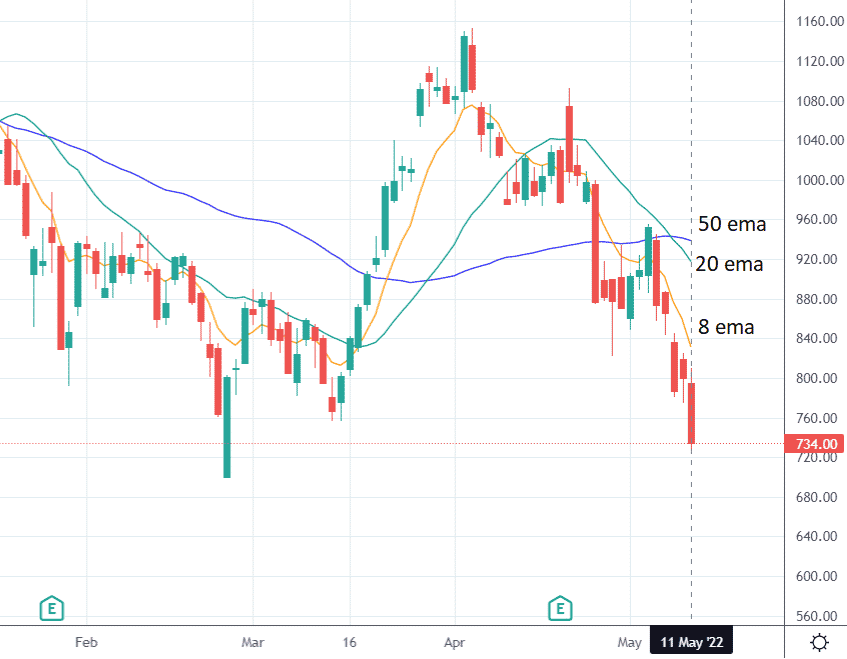

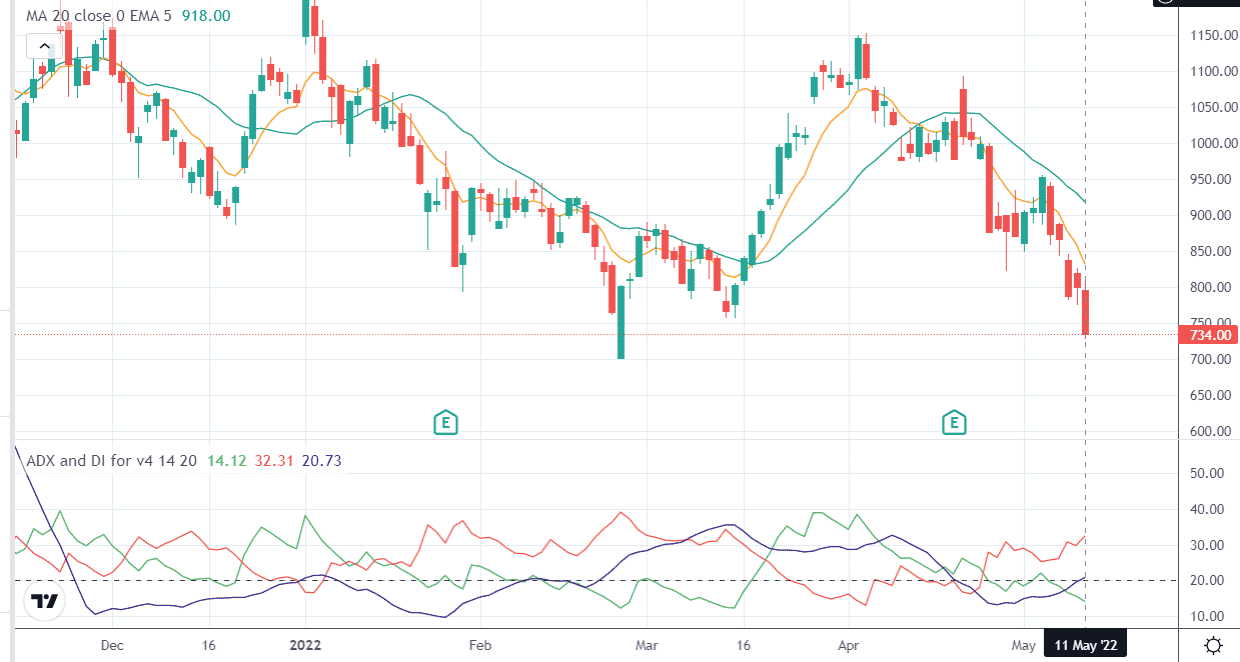

Bear Spread Overview, and Examples of Options Spreads, A bear spread is a bearish options strategy used when an investor expects a moderate decline in the price of the underlying asset. With markets looking more volatile, it’s a good time to check in on our bear.

:max_bytes(150000):strip_icc()/10OptionsStrategiesToKnow-04-d02438bef9d24de79e98dd8d29b157f8.png)

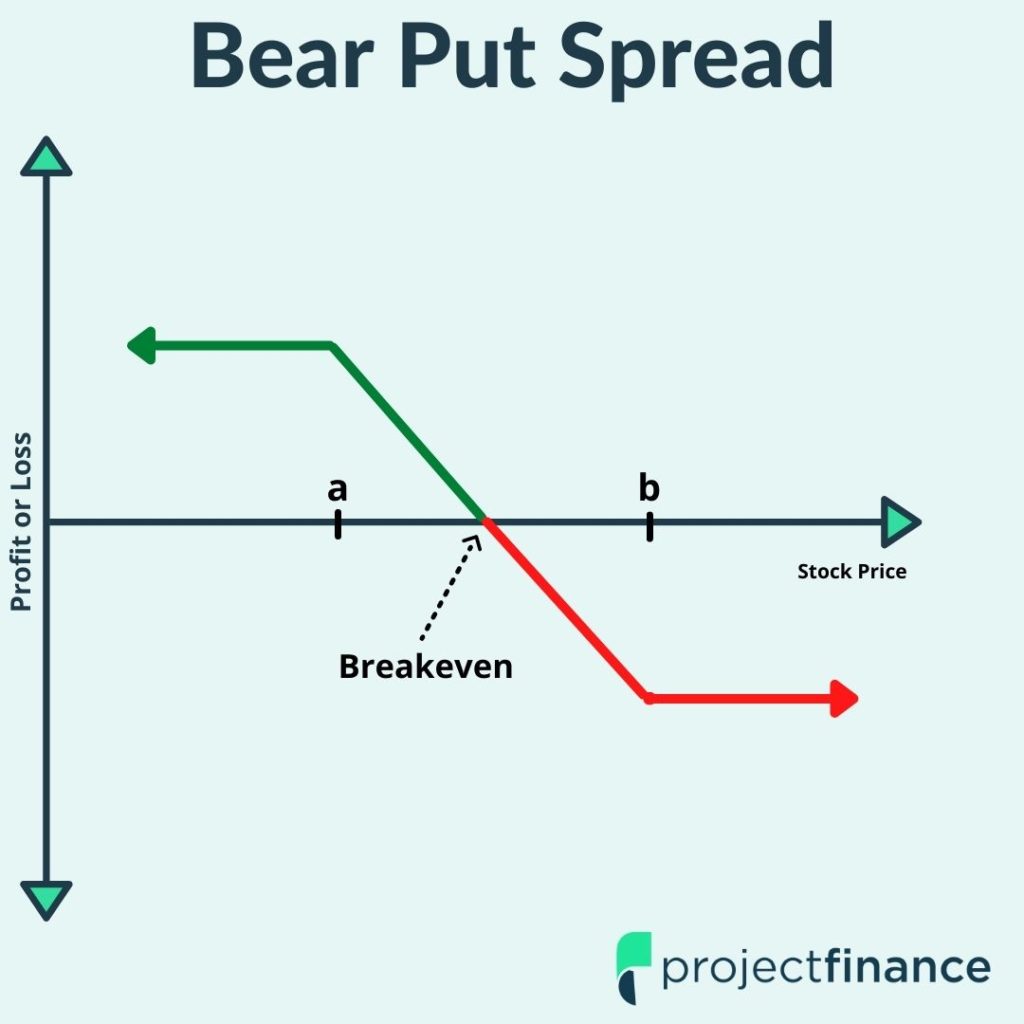

All About Bear Call Spread and Bear Put Spread Espresso Bootcamp, Try an example ($spy) what is a bear put spread?. Similar to the call spread, the put spread forms a key underlying component for certain more complicated trades, such.

Bearish Put Calendar Spread Option Strategy Guide, “i've said it earlier, trading. Bear put spreads are also known as put debit spreads.

The Ultimate Guide To The Bear Put Spread, This strategy allows investors to profit. “i've said it earlier, trading.

Bear Put Spread Explained Simply (2025) Trader's Guide w/ Examples, Bear put spread is best invoked when you are moderately bearish on the markets; “i've said it earlier, trading.

Bull Put Spread Example W/ Visuals The Ultimate Guide projectfinance, Fact checked by lucien bechard. A bearish calendar spread consists of two options.

Bear Call Credit Spread Option Strategy Guide, With markets looking more volatile, it’s a good time to check in on our bear. Bear put spread is an options trading strategy which is deployed when a trader’s view is moderately bearish on a stock or an index.

Bear Put Debit Spread Option Strategy Guide, Search a symbol to visualize the potential profit and loss for a bear put spread option strategy. They are a bearish options trading strategy that.

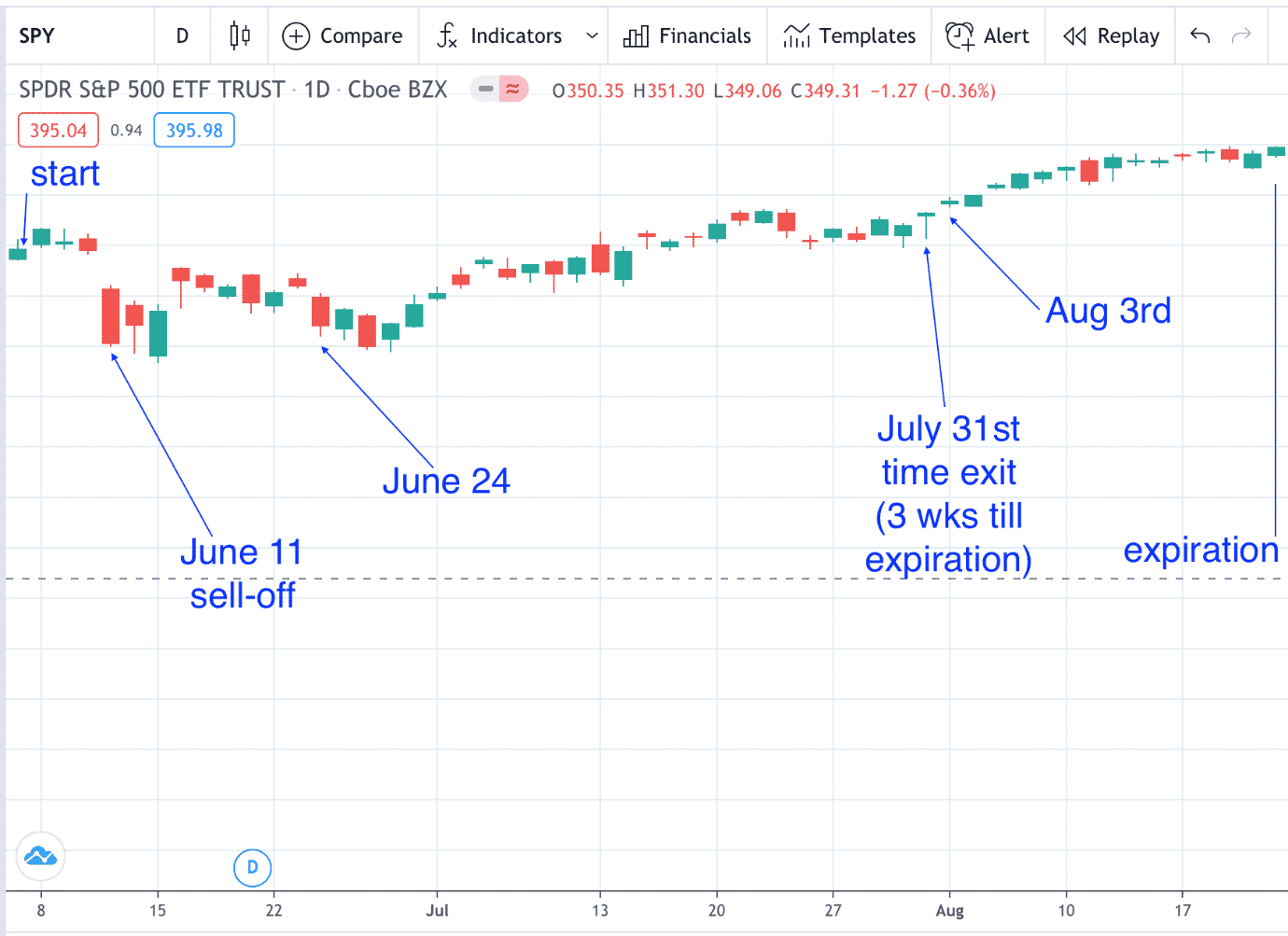

Bear Call Spread Overview and Examples of the Option Strategy, What is a call calendar spread? A long calendar spread is a good strategy to use when you expect the price to be near the strike price at.

:max_bytes(150000):strip_icc()/dotdash_Final_Bear_Call_Spread_Apr_2020-58026f10d7974d33a61e94f960aae0e3.jpg)

Bearish Put Calendar Spread Option Strategy Guide, A bear put spread is an options strategy implemented by a bearish. The bear put spread is a popular option strategy that allows you to profit from a moderate decline in the price of an underlying asset, such as a stock or an index.

A bear put spread is a vertical options strategy that consists of buying and selling put options on the same underlying security with the same expiration date, but at different strike prices.